Subscriber Login

To request access to our products and services or learn more about the IDEAcarbon/Veridium partnership, please e-mail us.

Climate Finance

Our sister company The Carbon Rating Agency has a range of products designed to empower public and private entities to scale, enable and profit from the business opportunities found within the growing field of climate finance.

The Carbon Rating Agency has benefited from testing its suite of climate finance products with our long established sister company IDEAglobal’s extensive network of Sovereign Wealth Funds, institutional investors and investment banks and knowledge of how these organisations consider investments in new asset classes.

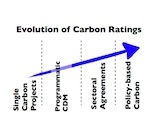

The Carbon Rating Agency provides a suite of ratings and analytical products covering the following carbon ratings, energy efficiency ratings and indices amongst others.

The principal role of the CRA product suite is as an enabler of climate finance, risk sharing between public and private stakeholders and for the construction of legitimate instruments necessary for this new asset class.

Environmental Markets & Energy Commodities

Working alongside our long established sister company, IDEAglobal, we provide impartial and directional outlooks on key assets within the environmental markets and energy commodities spectrum.

IDEAglobal’s range of expertise in global markets, combined with our own sectoral expertise enables us to provide informed and holistic market views. IDEAglobal has nearly 25 years experience providing information and advice to more than 500 of the most significant private investors in the world – including Sovereign Wealth Funds, institutional investors and investment banks which collectively control and manage the bulk of the world’s assets.

Our outlooks are used by risk officers, CIOs and traders in leading public and private sector organisations.

Climate Policy

We are privileged to have our climate finance pioneers and climate policy decision-makers on our advisory board, who have shaped, and continue to shape climate policy, both nationally and internationally, and have played a major role in putting climate and environmental markets at the top of today’s global agenda.

Our advisory board members, combined with the IDEAcarbon Policy Network, allow us to take a pro-active approach to climate policy. Our clients benefit from early policy insights, with direct benefits to their balance sheets, investor perceptions and environmental asset portfolios.